From Implicit to Explicit: The Impact of Disclosure Requirements on Hidden Transaction Costs

Abstract

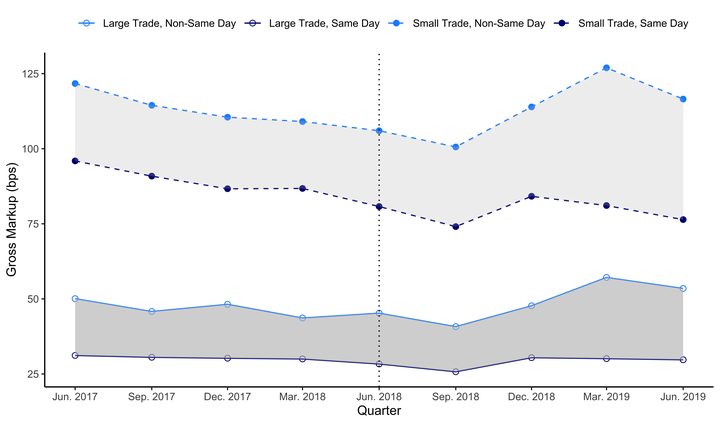

This paper provides evidence that disclosing corporate bond investors' transaction costs (markups) affects the size of the markups. Until recently, markups were embedded in the reported transaction price and not explicitly disclosed. Without explicit disclosure, investors can estimate their markups using executed transaction prices. However, estimating markups imposes information processing costs on investors, potentially creating information asymmetry between unsophisticated investors and bond-market professionals. We explore changes in markups after bond-market professionals were required to explicitly disclose the markup on certain retail trade confirmations. We find that markups decline for trades that are subject to the disclosure requirement relative to those that are not. The findings are pronounced when constraints on investors' information processing capacity limit their ability to be informed about their markups without explicit disclosure.