Tick Size Tolls: Can a Trading Slowdown Improve Earnings News Discovery?

Abstract

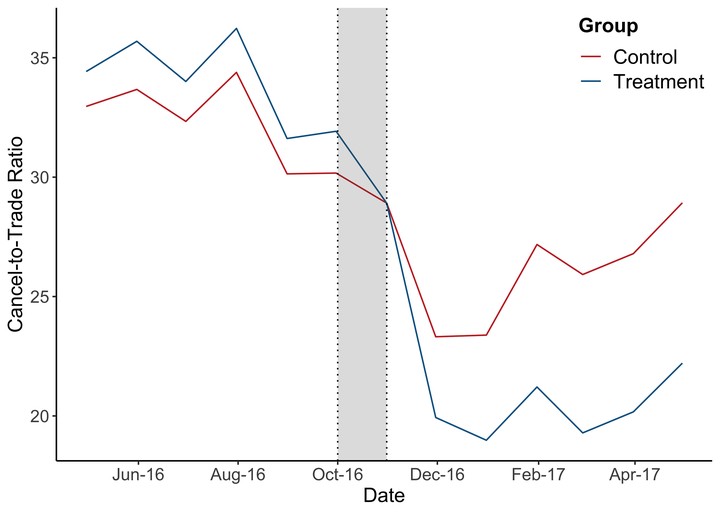

This study examines how an increase in tick size affects algorithmic trading (AT), fundamental information acquisition (FIA), and the price discovery process around earnings announcements (EAs). Leveraging the SECs randomized Tick Size Pilot experiment, we show a tick size increase results in a decline in AT and a sharp drop in absolute cumulative abnormal returns and volume around EAs. More importantly, we find increased FIA in the pre-announcement period. Specifically, we show: (a) treatment firms pre-announcement returns better anticipate next quarters standardized unexpected earnings; (b) these firms experience an increase in EDGAR web traffic prior to EAs; and (c) they exhibit a drop in price synchronicity with index returns. Taken together, our evidence suggests that while an increase in tick size reduces AT and abnormal market reaction after EAs, it also increases FIA activities prior to EAs.