Diversity Washing

Abstract

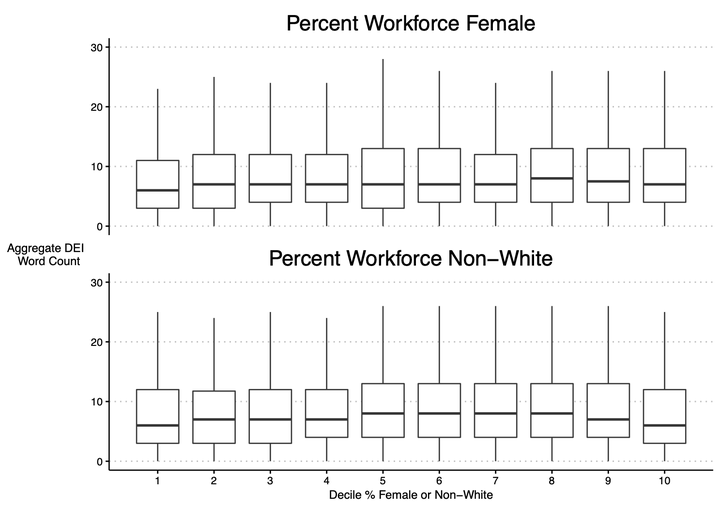

We provide large-sample evidence on whether U.S. publicly traded corporations use voluntary disclosures about their commitments to employee diversity opportunistically. We document significant discrepancies between companies' external stances on diversity, equity, and inclusion (DEI) and their hiring practices. Firms that discuss DEI excessively relative to their actual employee gender and racial diversity (``diversity washers'') obtain superior scores from environmental, social, and governance (ESG) rating organizations and attract more investment from institutional investors with an ESG focus. These outcomes occur even though diversity-washing firms are more likely to incur discrimination violations and have negative human-capital-related news events. Our study provides evidence consistent with growing allegations of misleading statements from firms about their DEI initiatives and highlights the potential consequences of selective ESG disclosures.