Information Acquisition Costs and Price Informativeness: Global Evidence

Abstract

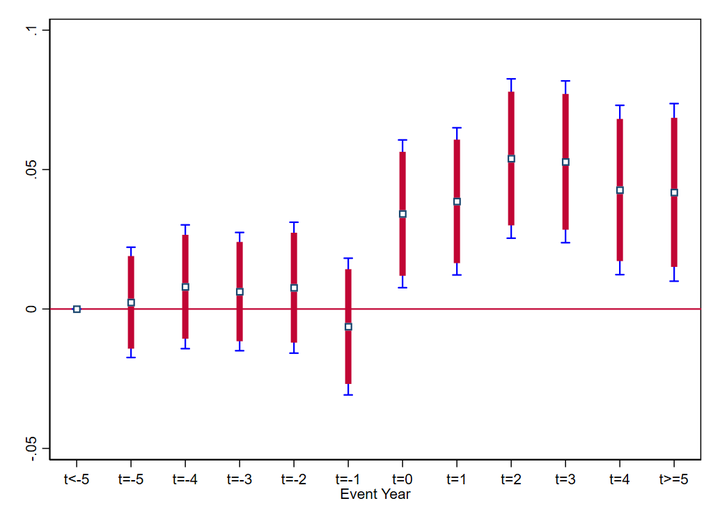

We study how global changes in information acquisition costs through disclosure technologies affect price informativeness. To provide evidence on this issue, we examine worldwide adoptions of centralized electronic disclosure systems, which significantly reduce the cost of and broaden access to financial disclosures. Consistent with extant theory, we show a significant reduction in private information acquisition around earnings announcements as a result of these adoptions. These effects are most pronounced in countries with the most substantial reductions in information acquisition costs and where we find more significant decreases in informed trade. Overall, we highlight an important, unintended cost of broadening access to financial disclosures through technology adoptions.