Retail Investors and ESG News

Abstract

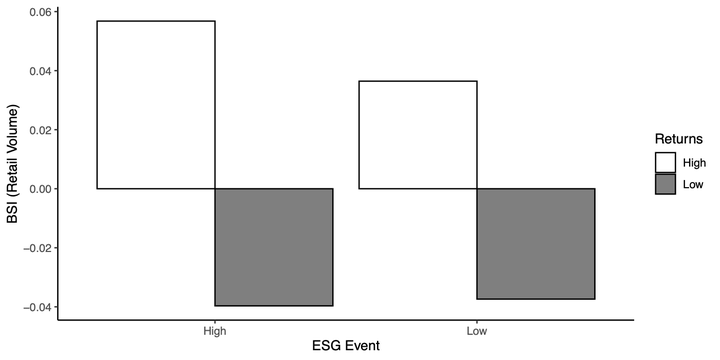

A critical debate exists around the extent to which retail investors do, or should, invest in socially responsible investments. We provide evidence relevant to this debate by investigating the aggregate trading patterns of retail investors around a comprehensive sample of key Environmental, Social, and Governance (ESG) news events for U.S. firms. Our focus on news-relevant events allows us to bypass measurement issues related to investors' frictions in becoming aware of and understanding ESG-related information. We show that ESG news appears to be an important component of retail investors' portfolio allocation decisions. Yet, inconsistent with non-pecuniary preferences, retail investors only trade on this information when they deem it financially material to a company’s stock performance. Moreover, their net trading demand predicts future abnormal returns, consistent with some ability to profit from transacting on ESG news. Overall, we conclude that retail investors care about firms' ESG-related activities, but only to the extent they are financially material for company performance.